This latest technical article examines our response to a typical (and recent) modelling support request. An x% uplift on the cost of certain capital assets is modelled in the surrogate context of a business case for VoIP over air.

This article demonstrates our close and flexible working relationship with customers.

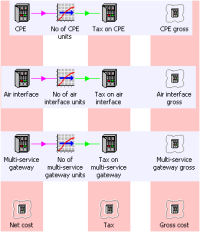

Here the modeller wished to apply a consistent treatment to capture tax on the sale

of goods, which essentially materialises as an x% uplift on the cost of certain

capital assets. We compare an in-line approach with a solution using an explicit,

secondary resource and then see how collections can be used to cut the costs both

ways (total per resource, and gross/net of tax for all resources) without writing

any additional formulae.

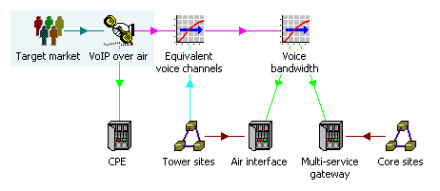

VoIP over air as a surrogate modelling context

Because of the confidentiality issues mentioned above, we need a surrogate modelling

context as the background for a self-contained written explanation.

For the purpose of this exercise, we have quickly created a simplistic network model

for the roll-out of a fictitious VoIP over air service. The only costs

considered are customer premises equipment (CPE), a generic air interface, and a

multi-service gateway at core switching sites.

Basic network model elements

Very briefly, each subscriber is assumed to use the service for an average of 20

minutes a day, generating ~67mErlangs of traffic in the busy hour. A per-site

Erlang B calculation yields the capacity required to achieve a 1% risk of blocking,

and then an allowance of 32kbit/s is made for each concurrent voice call (including

air-interface packet overhead).

The network is rolled out across 100 sites in Y1 in time for launch in January Y2.

The model tracks the capital expenditure and maintenance costs of the network as

customer demand grows.

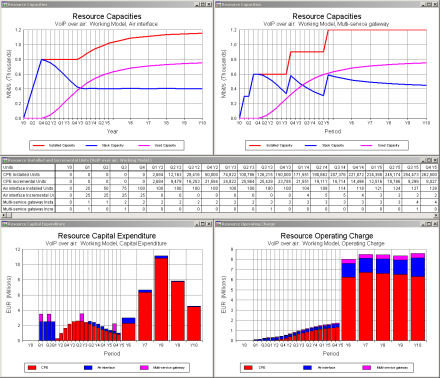

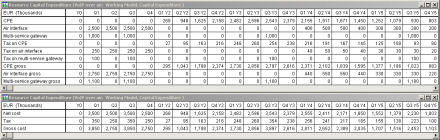

Inventory and net cost results

There is nothing remarkable about this initial analysis, which STEM will do for

you in minutes; this is just scene-setting and creative re-interpretation of the

original support question!

How can I model a 10% levy on selected capex and opex items?

The simplest solution is to take advantage of the User Data attached to each STEM

element, and craft a custom formula for the gross capital cost (or leased cost if

it is not a fixed asset). This is a core technique with myriad applications

wherever you need to extend the basic input space to accommodate all the dimensions

pertinent to a particular model.

- Select User Data from the icon menu for a resource. The User Data dialog is

displayed.

- Select Rename Field… from the Edit menu. The Rename Field dialog is displayed.

- Type ‘Net cost’ and press <Enter>. The first row (User 1) is labelled

as ‘Net cost’.

-

Move

the cursor down to User 2 and rename this as ‘Tax rate’.

Move

the cursor down to User 2 and rename this as ‘Tax rate’.

- Enter suitable values for Net cost and Tax rate. (These may be time-series.)

- Define the Capital Cost input with the formula, ‘Net cost’ * (1 + ‘Tax rate’).

You can click with the mouse to pick up the ‘Net cost’ and ‘Tax rate’ references

so that you don’t have to type them.

Now the tax is built in to the core Capital Cost input which STEM works with, and

the results will be automatically uplifted for each affected resource. If

the tax rate is the same for all resources, it would be more sensibly placed

in global User Data. And if you prefer to type the formula yourself, then you may

also prefer to avoid spaces in the variable names so as not to need the single quotes.

This is very easy to set up, and concise because the calculation is kept ‘within

the icon’. However, the results are only granular down to the individual element.

So if you want to report on the tax separately, or show the net/gross split for

an individual resource, another solution will be required.

Companion resources are the most flexible way to add new cost headings

STEM already has a range of built-in cost attributes, such as capital and maintenance

costs for fixed assets, and rental and usage costs for leased facilities, with a

very specific interpretation for reporting purposes and calculation from standard

inputs. If you want to introduce altogether separate cost heading in the results,

then it is usually better (clearer, and more flexible) to use separate resources

for each separate heading, and to use collections to aggregate them as required.

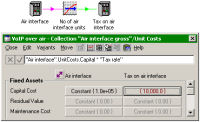

We will work through how this can be done for the Air interface resource

in the example above.

- Create a new transformation from the toolbar, named as ‘No of air interface units’.

-

Control-drag

the resource onto the transformation to establish the resource as an input.

Control-drag

the resource onto the transformation to establish the resource as an input.

- Double-click the input link (pink) to review the input settings and change the basis

to Installed Units.

- Create a new resource from the toolbar, named as ‘Tax on air interface’.

- Control-drag the transformation onto the tax resource to create a requirement link

(green).

With a default capacity of 1.0, the tax resource will be installed in identical

quantities to the original air interface. We need to set two more inputs to

calculate the tax correctly.

-

Set

the physical lifetime to match the original resource, as well as any pre-run profile,

so that replacement demand will be synchronised too.

Set

the physical lifetime to match the original resource, as well as any pre-run profile,

so that replacement demand will be synchronised too.

- Define the capital cost with a formula which references the original capital cost,

and the tax rate in User Data.

This technique can be repeated (with copy and paste) for whichever assets are affected,

and just as easily for opex costs as for the capex example shown. When you access

the results, you will see results for Tax on air interface alongside the

original Air interface results.

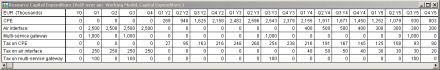

Net costs and tax for each network element

But what if you want to see the gross cost, or to see the impact of tax across all

affected resources?

Using collections to aggregate and group costs in different ways

The collection concept in STEM can be used to group any arbitrary set of model elements,

and to provide automatic calculation of aggregate results when all the grouped elements

are of the same type. So we can use one collection to calculate the gross Air interface

cost, and another to add up tax across all resources.

-

Select

both the Air interface and Tax on air interface resources, and

then click the

Select

both the Air interface and Tax on air interface resources, and

then click the  button on the toolbar. A new collection is created, grouping the two resources.

button on the toolbar. A new collection is created, grouping the two resources.

- Name this as ‘Air interface gross’.

- Repeat for the other network elements, CPE and Multi-service gateway.

- Now select all of the tax resources and create another collection, named ‘Tax’.

- Create similar collections for the total net cost and total gross cost, as shown.

- Use the Colour Block command from the icon menu for the total collections to change

the colour of the columns, as this makes the two-way aggregation clearer.

This structure is a side-calculation from the main business plan, and is best displayed

in a separate view to avoid cluttering the central logic. Each view provides

a different perspective of the model: the icons for the original network elements

appear in both views, but link to the same core data.

The collections in each row request the logic to add the net cost and tax to give

the gross cost for each individual network element, while the collections in each

column sum these respective costs over all network elements to report on total net

costs, total tax and total gross costs.

Tax and gross costs summed over all network elements

Transparent and self-documenting cost accounting

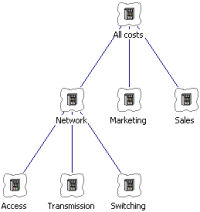

Although this might look like a lot of effort for little gain, the same structure

can be readily extended across much larger models with copy and paste. A huge benefit

is that the row and column sums are generated automatically, so there are few calculations

to check. The resulting solution is easy to understand and gives both modeller and

reviewer increased confidence in the consistency and integrity of the results.

A

similar technique may be used to impose arbitrary aggregation hierarchies on an

existing model, perhaps grouping elements by network function in one direction (access,

transmission, switching, and so on) and supplier in another (vendor 1, vendor 2,

…).

A

similar technique may be used to impose arbitrary aggregation hierarchies on an

existing model, perhaps grouping elements by network function in one direction (access,

transmission, switching, and so on) and supplier in another (vendor 1, vendor 2,

…).

Collections can also be nested, so you might group all of these network functions

alongside separate collections for sales and marketing, which would in turn aggregate

their relevant costs. The icon hierarchy directly explains the aggregation structure

of the results, so the accounting model becomes self-documenting.