With the increasing prevalence of virtualised networks, the scope of network

business models is transported to the realm where the software is

managed and is either executed or orchestrated.

We have created a reference framework for modelling the IT value-chain in a web-scale

enterprise which extrapolates conventional revenue and cost modelling from the hardware

and site to value-added IaaS, PaaS and SaaS layers. This structure can then be used

to compare buy/build scenarios for delivering services built on either third-party

or in-house platform / infrastructure / physical data centres.

1. Network economics is increasingly focused on the data centre

The data centre is now ubiquitous in carrier and web-scale business infrastructures.

Very high speed fibre and all-purpose IP networking have driven an inexorable migration

of ‘the intelligence’ in a network from local offices to centralised

facilities which facilitate, as a consequence of their greater scale and smaller

number:

- higher equipment utilisation

- massive operational efficiency

- (ease of achieving) more consistent platforms

- faster response to configuration faults in higher layers.

The data centre is the new network for economic modelling and

business insights!

Figure 1: Inexorable migration of network intelligence from local offices to centralised

facilities

2. From hardware and site to IaaS, PaaS and SaaS layers

Running your own hardware may not be in vogue, but you need a model if you are going

to evaluate the alternatives. We have modelled the data centre as a value chain

to help determine at which layer you have the best scale to operate. The cost of

the raw physical assets may be compared with the price of consuming IaaS, and higher

layers in turn.

Physical layer:

- compute, storage and network

- building, power, cooling, UPS

- deployment, operations, security

|

IaaS:

- VMlarge, VMmedium,

VMsmall

- VMimage, storage

- VLAN, firewall, load balance, IP address, etc.

|

Paas:

- OS, scripting, web, database, etc.,

- running on elements of IaaS

|

Saas:

- managed email, backup, etc.

- running on elements of PaaS

|

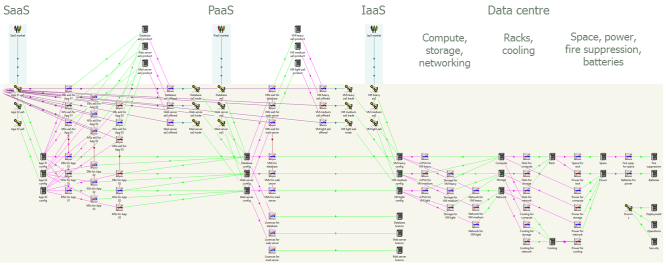

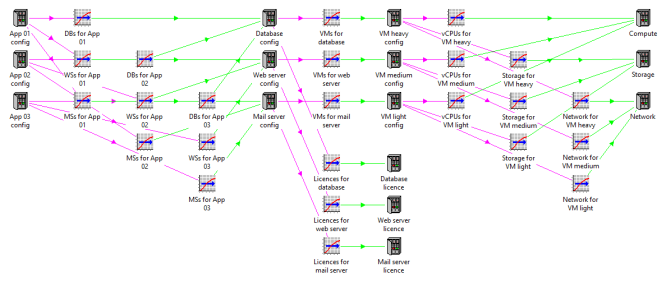

Figure 2: Value-chain elements for a data centre offering SaaS, PaaS and IaaS services

Starting from the customer, the value-chain model considers:

- business applications, requiring

- platform elements, requiring

- VM configurations, requiring

- compute, RAM and storage resources in a data centre, plus

- space, power, cooling, etc., across

- multiple sites in global network

- ‘point and click’ scenarios; e.g., On premise

/ Cloud / Hybrid cloud

- multi-layered cost allocation, ‘out of the box’.

Figure 3: Connecting business applications with the value-chain elements of a physical

data centre

3. Build from products or components

It is an interesting question as to whether the economics are better for a platform

or software operator to build their solution on IaaS (or PaaS) rather than the raw

hardware:

- if an IaaS operator prices keenly, then their margin should

match the operational benefit for a client not having to maintain its own physical

assets and being able to focus on its main value-add

- however, the initial hype may have allowed operators to over price (they might say,

“to recoup R&D”)

- a fair deal should be negotiated

- a model is required to establish an objective reference point on pricing.

Our model uses scenarios to compare the following approaches:

- SaaS on PaaS

- SaaS on IaaS

- SaaS on physical

- PaaS on IaaS

- PaaS on physical.

The same structure can be used to evaluate which model to use for your own business

applications and activities:

- SaaS vs PaaS vs IaaS vs physical

- where do you have expertise/scale?

- what is your value-add/focus?

In order to properly evaluate a hybrid cloud scenario with a mix of third-party

platform/infrastructure aaS and in-house components,

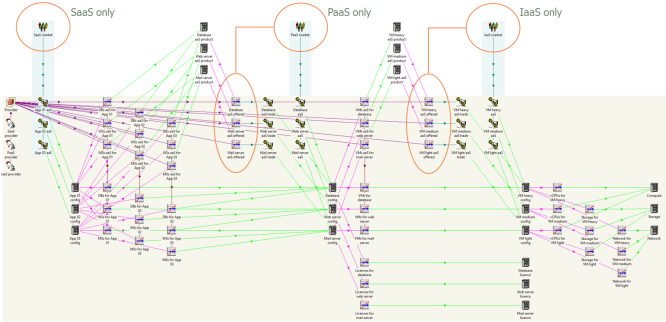

it is necessary to model independent SaaS, PaaS and IaaS operators in parallel so

that each pool of resources achieves a level of utilisation reflecting the scale

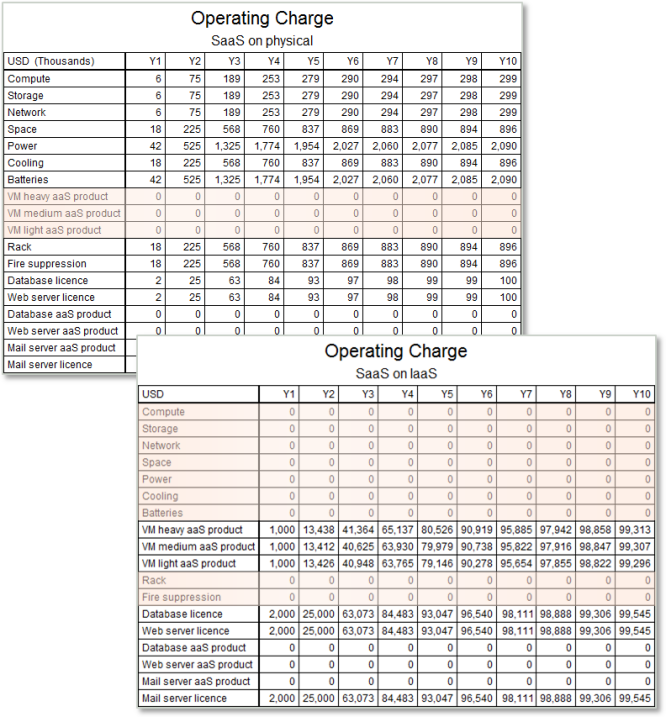

of the owning operator. The results shown below compare in-house data-centre costs

with a mix of aaS product costs.

Understanding the value-chain in a data centre is fundamental.

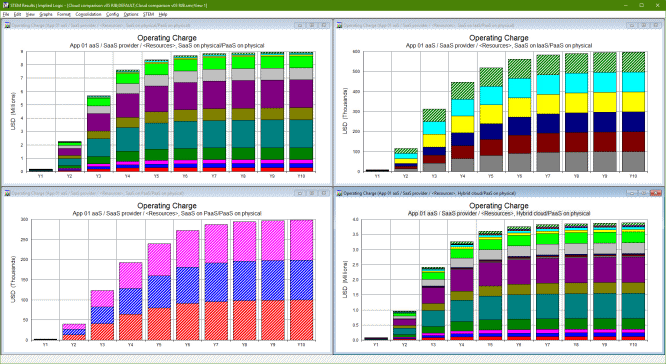

Figure 4: Systematic and consistent cost breakdown across different buy/build scenarios

4. De-composition of the model (incremental development steps)

You could say that this looks quite complicated! Actually,

none of the individual components is complicated at all. Even the appearance of

the operator ‘template driving itself’ is nothing special when you look

at it closely.

However, the model certainly didn’t happen all at once! Instead it started

with a sketch of the single-player technology stack. Visualising this in the Editor

made it easier to grasp the commercial structure and to consider how best to model

the multi-player context. The evolution we will follow in the remainder of this

article goes like this:

- the basic technology stack

- configuring a product from these basic ingredients

- a value chain as an alternative economic view

- scenarios for utilisation of platform resources

- modelling hybrid cloud

- replicating the solution stack for the different players

- seeing the template cross-linkage for what it is

- scenarios for the build options for SaaS and PaaS.

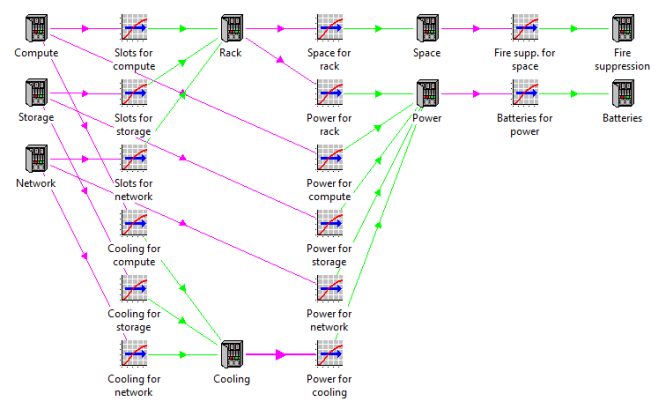

4.1 The physical technology stack

Processing in a data centre usually involves compute, storage and networking. These

in turn require racks and cooling. Racks require space and pretty much everything

requires power. Space requires fire suppression (and security and light and so on)

and power requires battery backup.

Figure 5: The physical technology stack

4.2 Configuring a product from these basic ingredients

A virtual machine (VM) may be defined in terms

of its compute, storage and networking elements. A range of configurations may be

offered at a certain price per performance.

A web server may be delivered on a particular VM

configuration, together with a suitable software licence. A

business application may combine any/all of these elements.

Figure 6: Configuring an application from platform, infrastructure and physical

elements

4.3 A value chain as an alternative economic view

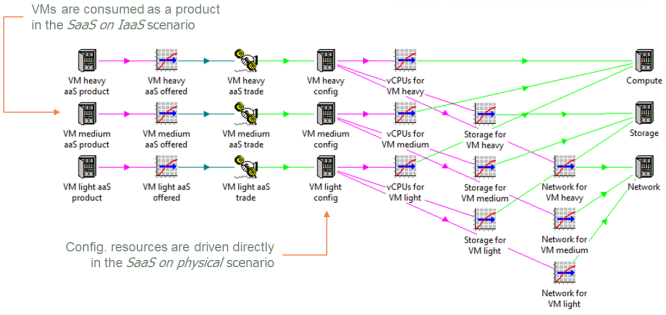

If each layer of resources drives the next directly (i.e., via a series of transformations),

then every cost will be allocated and directly visible to the business application.

However, if a SaaS provider builds the app using VMs from a third party, then his

only concern is the VM subscription; the data centre costs are for the third-party

IaaS provider to worry about.

Figure 7: In-house and third-party aaS cost structures

compared

This approach can be modelled as a value chain

in STEM by inserting an extra service (IaaS provider) between a VM product resource

and its constituent resources in the data centre.

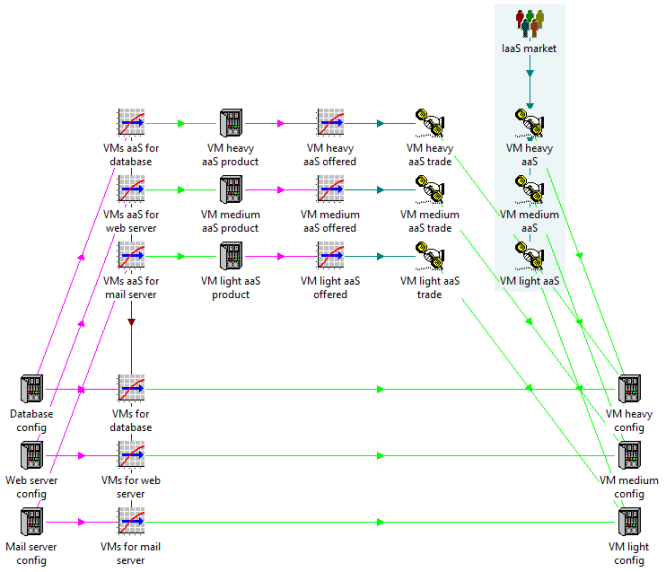

Figure 8: Value-chain elements in STEM

The ‘trade’ service must set the input Value Chain

= Commodity, and then:

- the revenue charged by the ‘trade’ service appears as an extra cost

with the ‘product’ resource

- the gap between revenue and cost (allocated from the data centre) is the margin

for the IaaS provider.

The original ‘config.’ resources are retained for build consistency

when comparing scenarios where they may also be driven directly by in-house build

transformations.

Note: Currently the ‘offered’ transformation must have Type = Resource.

4.4 Scenarios for utilisation of platform resources

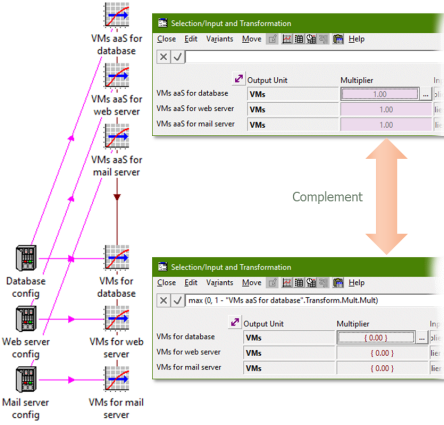

To compare the case for SaaS on physical with SaaS on IaaS, you could just add the ‘product’

resources in isolation and set the rental cost to a market rate. However, the value-chain

approach demonstrates the profitability of the IaaS provider on an equivalent basis

(differing only in utilisation) that makes the overall comparison more credible.

Either way, all you need is a set of scenario parameters which control the VMs aaS for x transformations (i.e., the multipliers

for the VMs aaS for database / web server / mail server

transformations). Then the VMs for x transformations

are just defined as a ‘1–’ complement.

Figure 9: Scenarios for platform resources

What is actually going to make the VM products any cheaper when they are sold as

a service? Answer: economy of scale.

Where does that scale come from? Answer: a wider market.

So, an external customer base must be added to our SaaS on

IaaS scenario in order to deliver a lower unit cost (as an allocated

share of a greater overall cost). This requires a parallel set of external services,

since the value-chain services capture only the internal demand.

Figure 10: External market for platform resources

5. The case for hybrid cloud in a web-scale enterprise

Public cloud services offer great efficiencies through massive scale. They can also

offer on-demand flexibility at a better price than owning your own compute assets

which would only be used for a fraction of the time.

Figure 11: On-demand processing can be shared with other clients in a public cloud

Private cloud capabilities are less efficient and may be regarded as a non-core

business distraction, but may have to be part of the mix:

- due to regulations on sensitive customer or financial data

- due to cross-border privacy issues

- if custom processing is required.

How will you determine the best approach? The data-centre value chain is just right

for comparing the options:

- the public cloud approach may be characterised by the consumption of the relevant

SaaS, PaaS and IaaS services (mix of fixed and variable) with the consumed service

revenues as the effective cost

- the private cloud approach takes the same requirements and pushes them through to

the underlying hardware costs

- or you may consider a suitable public–private cloud split.

Whatever the technical options, a rational investor will increasingly demand to

see a robust illustration of the underlying economics!

5.1 Modelling hybrid cloud

The expected business results are a kind of compromise between:

- the more efficient cost of highly-utilised public cloud resources and

- the relative inefficiency/expense of a dedicated private cloud.

How can this model generate two different sets of utilisations for the same underlying

resources within a single consistent scenario? Answer: we need a separate perspective

for each provider:

- SaaS requires all layers

- PaaS doesn’t need SaaS (and doesn’t use PaaS)

- IaaS doesn’t need SaaS or PaaS (and doesn’t use IaaS).

Figure 12: Different perspectives for each provider

We can use a template to replicate the entire single-player stack once for each

provider:

- disregard the layers not required

- identify which provider sells the product resources in each layer.

In a commercial model of specific cloud providers, there might be significant differences

in internal configuration of products which would provide a compelling reason to

model each provider explicitly. In contrast, the template gets the model built quickly

and provides an elegant way to highlight the impact of scale and sites alone.

Figure 13: Replicating the solution stack for the different providers

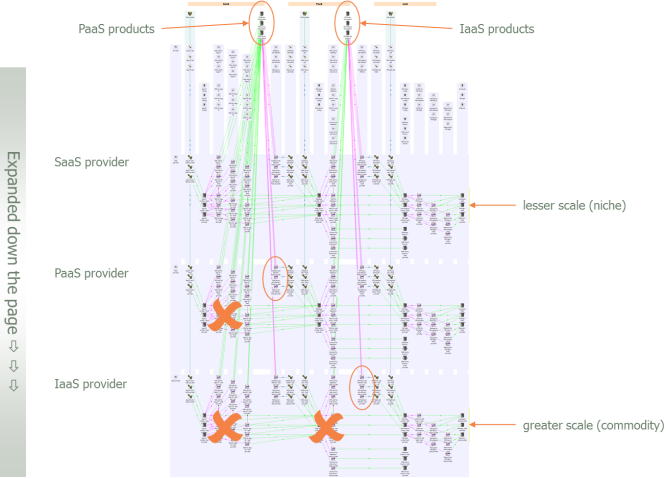

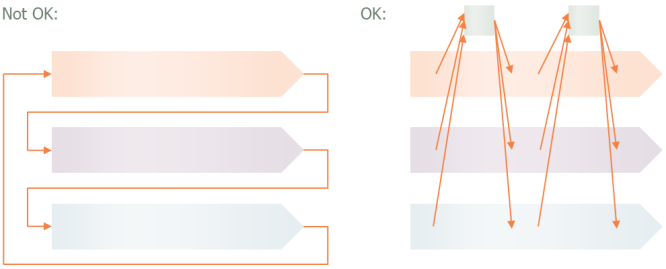

5.2 Seeing the template cross-linkage for what it is

If you consider that the template appears to ‘drive itself’, then you

could be forgiven for thinking that the model might be circular.

However, this impression is an over-simplification: while it is true that some elements

of the template drive others of the same template, in fact the links are all ‘left

to right’ and nothing drives back to the start or input of the template.

Figure 14: Different classes of template cross-linkage

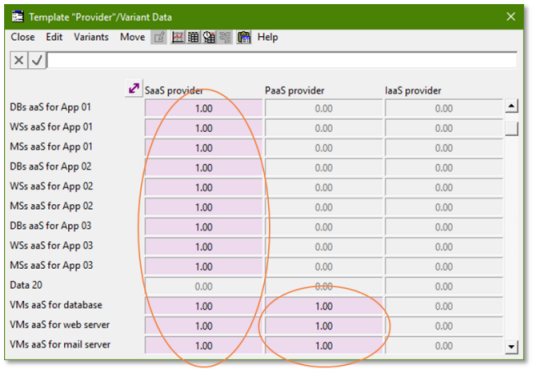

5.3 Scenarios for the build options for SaaS and PaaS

Our template has parameters which govern (for each provider):

- the market for relevant service layers

- identification with the ‘trade’ demand from each previous layer

- the proportion of servers bought as PaaS products

- the proportion of VMs bought as IaaS products

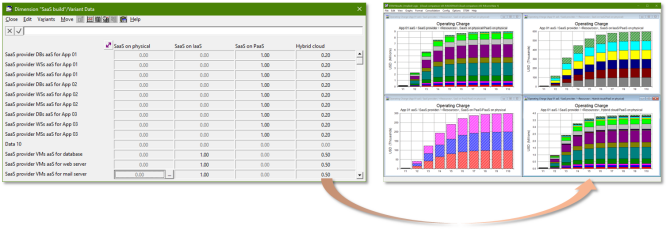

In order to vary the build for both the SaaS and PaaS providers, we can introduce:

- scenarios for both proportions (specifically for the SaaS provider)

- scenarios for the VM proportions (specifically for the PaaS provider).

Figure 15: Scenario parameters for the provider-template build options

The ‘black and white’ scenarios like SaaS on IaaS

set these values to ones or zeroes. In contrast, the Hybrid

cloud scenario for SaaS features a mixture of internal and

aaS at each level as shown below.

Figure 16: Scenario values and associated results for the SaaS build options

Next steps

The focus of this exercise was to consider different commercial models in the cloud

era. The model does not go into any technical detail about the internal configuration

of a data centre and this level of textbook STEM modelling is left as an exercise

to conduct in private with individual clients. The modelling framework itself could

be further layered to differentiate between data centre tenant, facility provider

and building landlord.

Various applications were explored at the

STEM User Group Meeting in October 2016, including the delivery of network

virtual functions or a managed backup service. There is no doubt that the ascent

of software-defined networking promotes an increasing layering and range of actors

and opportunities in the connected landscape.

Implied Logic can work with you to customise this methodology to your individual

market and current network position in order to fast track a credible financial

assessment of your strategic options.

This framework was first presented at the

Networks 2016 conference in Montréal on 26 September 2016. The supporting

paper, Elements of techno-economic modelling for the planning,

provisioning and operation of virtualised networks, is published on IEEE Xplore and some portions of the text above

are © 2016 IEEE.